Our Sustainability Approach

Sustainability is important to our business and embedded into business processes.

Our approach to sustainability is focused on meeting the demand for smarter, climate-resilient, healthier and accessible buildings for our tenants and residents. We want to create inclusive and livable spaces, while operating our clients’ portfolios efficiently in a manner that supports the transition towards a low-carbon economy.

Embedding Sustainability

We continue to evolve and deepen our approach to integrating sustainability principles into aspects of our business – from our values and strategies to our core processes as a vertically integrated real estate adviser. Our sustainability framework reflects our five pillars that support our business and societal ambitions, which we have aligned to the United Nations Sustainable Development Goals (UN SDGs).

We work to make equity, diversity and inclusion a part of our value proposition in how we attract talent, deliver an exceptional tenant experience, and contribute to stronger, livable communities.

We continue to develop our clients’ buildings in a way that supports safe, inclusive and sustainable communities.

We are working towards natural resource conservation by improving operational efficiency, reducing the consumption of energy, materials and water, and encouraging sustainable materials through our procurement processes.

We are reducing the carbon intensity of our managed assets and working to make assets more resilient and adaptive to climate-related risks and natural hazards.

We adhere to our parent company’s ethical and legal standards – managing risks and embedding our values-based culture in our everyday decision-making processes.

Setting Clear Priorities

In alignment with international sustainability standards, we conducted a prioritization refresh exercise using the double-material principles to identify the topics with the greatest impact to our business and society. We followed a four-step process:

Understanding Organizational Context

Identifying Impacts

Assessing Impact Significance

Prioritizing Impacts

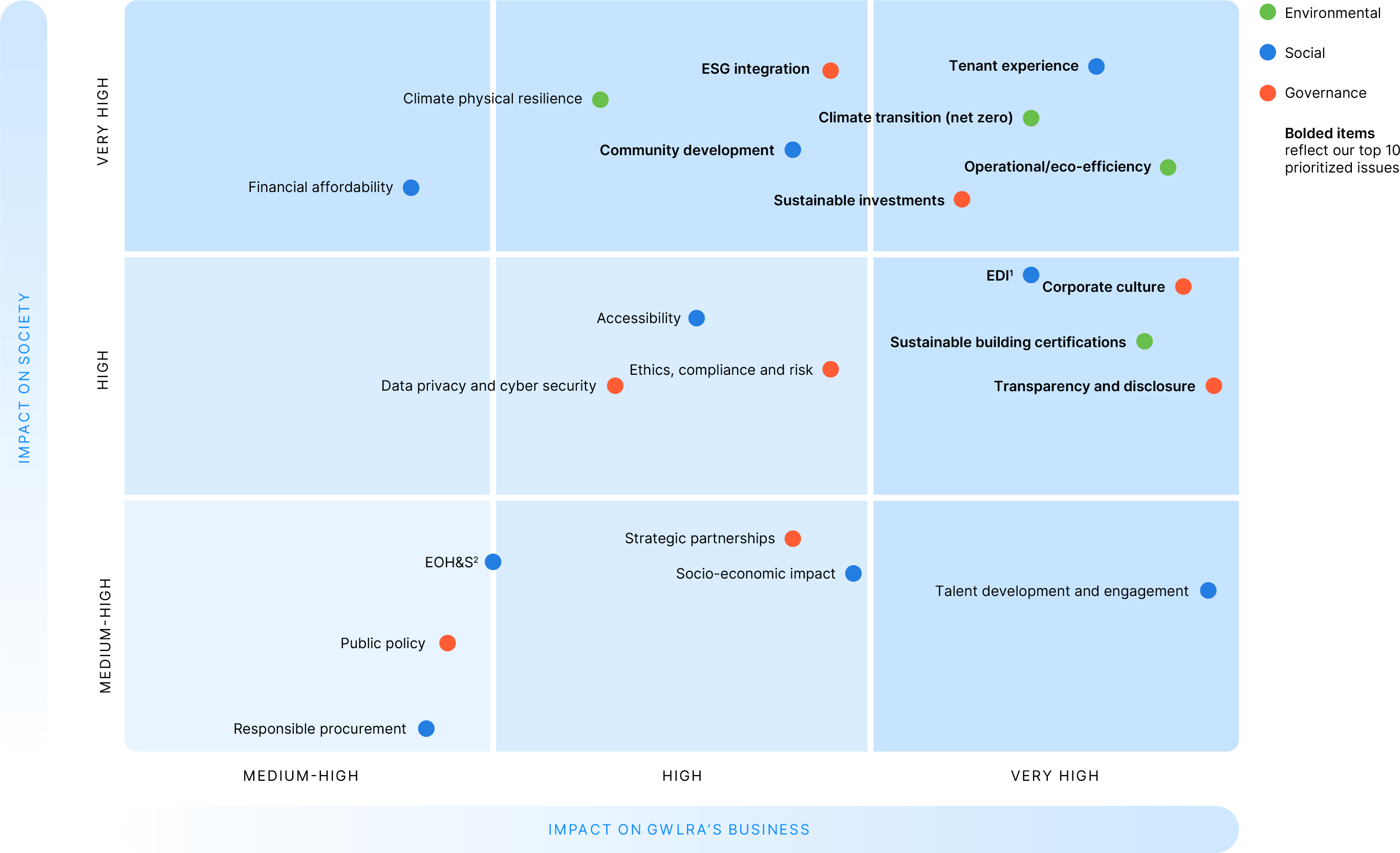

Prioritization Matrix

We reflected our prioritized topics on a matrix, highlighting their relative positioning as it relates to the impact on our business and the impact on society. These topics were mapped to our five strategic pillars, which support and are aligned with our strategic business objectives and priorities.

1 EDI (Equity, diversity and inclusion)

2 EOH&S (Environmental, occupational, health and safety)

Stakeholder Engagement

We are in the business of navigating investment risks and opportunities. Our role in solving the challenges facing the environment and society is to protect and advance the interests of our clients, policyholders, shareholders and other stakeholders.

Engagement Process

Engaging with our stakeholders is part of how we build trust. This is done in the normal course of our business through day-to-day interactions with our clients, tenants, third parties, employees and other partners – and through more formal and structured activities, specifically during development project approvals, tenant interactions, and representation at various business associations.

Raising Concerns

We have in place formal mechanisms for stakeholders to engage with us on issues of mutual interest. In addition to the contact information on our website, stakeholders can raise concerns through our legal and compliance department. We have a whistleblower policy and guidance, and take seriously all concerns raised, respecting confidentiality as far as possible.

How Do We Engage Stakeholders?

We actively engage with community organizations through partnerships and sponsorships, including with Habitat for Humanity, to address societal and environmental issues related to sustainable real assets.