Understanding Office in 2024: An Office Market Cycle Encounters the Paperless and Digital Workplace Era

Office vacancy rates post-covid have increased because of both cyclical and structural factors. A wave of new supply has combined with the longer-term trend of office work going paperless and wireless. COVID-19 did not create either circumstance. GWL Realty Advisors (GWLRA) analysis reveals that office space remains in demand although it will take time to work through elevated vacancy.

The normalcy of office cycles

Because of building size, development timelines and capital costs, the office asset class experiences more pronounced cycles and greater fluctuations in vacancy than other asset types. Vacancy rates typically fall when the economy booms and growing organizations lease more space. Eventually low availability triggers new, large developments. When these finally open the economy has often slowed alongside new demand. While the new buildings tend to be pre-leased, it is often from tenants vacating older buildings, which are then slower to re-lease during a sluggish economy, resulting in higher vacancy rates.

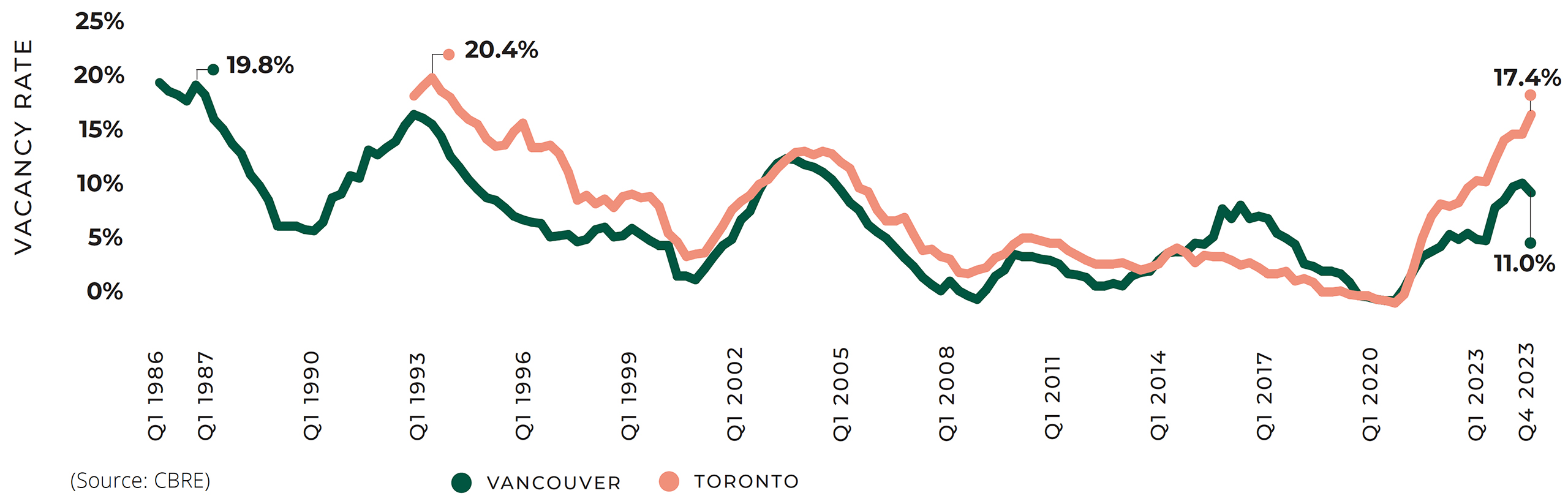

Figure 1. Downtown Office Vacancy Rate

CBRE has good vacancy data back to the 1980s and 1990s for Vancouver and Toronto (other markets only back to 2000). This chart illustrates the cyclical nature of office markets

The Digital Impact – structural downward shift in office requirements per worker

The biggest difference between pre- and post-covid office work is the final embrace of being fully digital. Paper copies are no longer the masters. Digitally-signed documents—such as via “Docusign”—are now the version archived. No need for vast banks of filing cabinets and tall shelves filled with paper. Legal, accounting and financial firms have collectively shed tens of thousands of square feet across Canada previously used to store law libraries, case files, client reports and other paper.

Additional workplace efficiencies come from wifi-enabled laptops along with smart phones that have removed the need for physical cables that previously tethered office workers to a single assigned desk. These shifts also enabled occasional remote work for many, regular telecommuting for some, and offshoring for certain roles, all slowing reducing office requirements per employee.

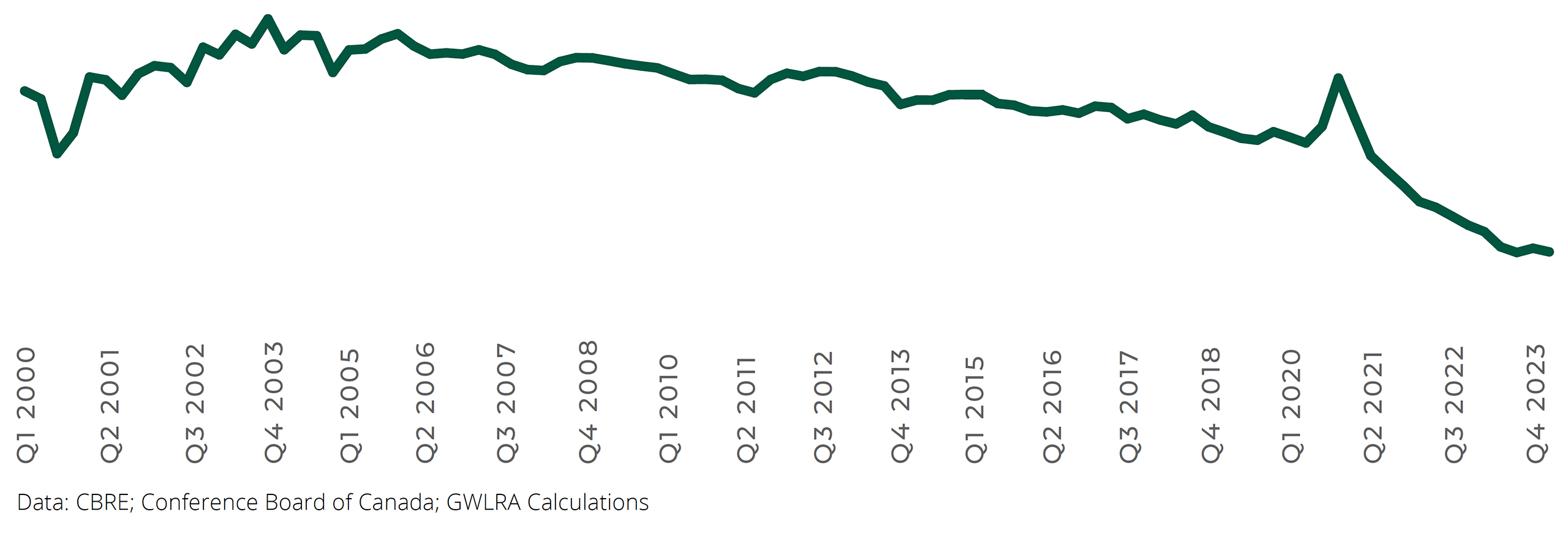

Although COVID-19 accelerated the trends, reducing paper and becoming mobile began in the early 2000s. During these years the amount of office space leased per worker began to decline steadily, as Figure 2 illustrates. As leases expired, and technologies evolved, organizations looked to re-make their spaces taking fewer square feet per person.

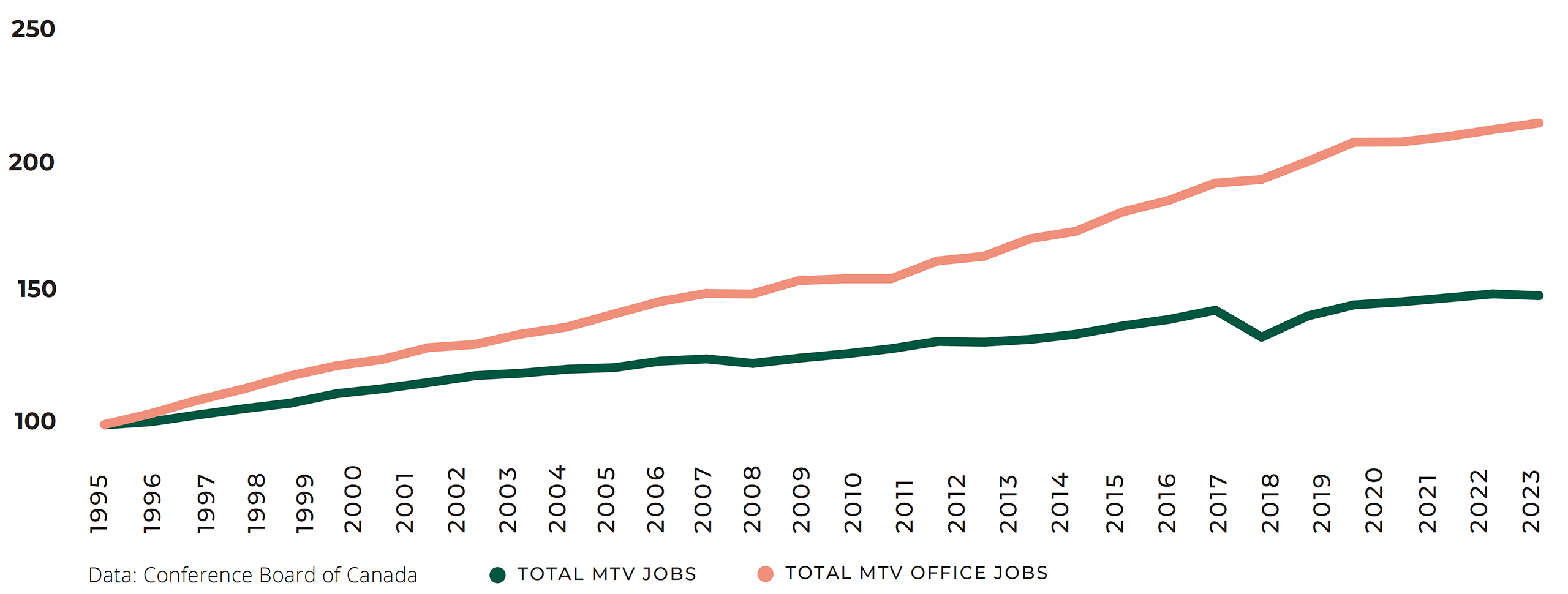

Strong office-oriented job growth trends partially hid this transition to less space per worker. Office-oriented employment from 2010-2020 expanded 26% in the three largest Canadian metros, whereas total jobs only grew at 11%. Today, office-oriented employment growth has slowed or stalled, making the reduced demand per person more visible.

Figure 2. Canada Office Utilization Rate (Occupied Office Space per Office-Oriented job)

Figure 3. Total Average Annual Employment vs Average Annual Office Employment. Toronto-Montreal-Vancouver combined. Indexed. 1995=100

Looking ahead: confidence office conditions will improve

This shift to needing less space per person is a one-time structural change in office usage patterns. As the last long-term leases that allocated for vast amounts of paper end, the impact will be fully absorbed within the office markets.

A gradual, cyclical recovery is taking place. In markets like Downtown Toronto, where the new supply wave has not finished, we anticipate elevated vacancy for longer. In Vancouver, vacancy could trend down more quickly, with other markets in between.

GWLRA is confident in the office asset class long-term and is upgrading existing assets to better match the needs and expectations of tenants today. Model suites that tenants can move into on short notice and are both popular with tenants and cost effective for landlords, and GWLRA is having success with this approach. A single interior layout or design can accommodate a wide variety of tenants from tech companies to financial firms or a variety of professional service entities; any organization that relies on mobile devices, an open plan office, and cloud computing can use the space. Increased amenities such as fitness and bike-commuting facilities, elevated food offerings, and shared tenant meeting and social spaces are further examples of upgrades that have happened or are underway across the GWLRA office portfolio and are attracting new tenants. Office tenants today have options, want an elevated experience, and GWLRA is delivering on that need thereby also improving the performance of our assets.

Research Team

Wendy Waters

Vice President, Research Services and Strategy

Anthio Yuen

Senior Director, Research Services and Strategy

Vaishali

Senior Analyst, Research Services and Strategy

This report is for general information purposes only and is not intended to provide any personalized financial, investment, real estate, legal, accounting, tax, medical or other professional advice. While the information contained in this report is believed to be reliable and accurate at the time of posting, GWL Realty Advisors Inc. and its affiliates (“GWLRA”) does not guarantee, represent or warrant that the information contained on this website is accurate, complete, reliable, verified, error-free or fit for any purpose. No endorsement or approval of any third party or their statements, opinions, information, products, or services is expressed or implied by the contents of this report.

GWLRA expressly disclaims all representations, warranties or conditions, express or implied, statutory or otherwise, including, without limitation, the warranties and conditions of merchantable quality and fitness for a particular purpose, non-infringement, compatibility, timeliness, security or accuracy. The user assumes full responsibility for risk of loss of any nature whatsoever resulting from the use of this report. For more information concerning the terms and conditions of use of this report, please refer to our website at https://www.gwlrealtyadvisors.com/general-disclaimer.

GWL Realty Advisors Inc. generates value by creating vibrant, sustainable communities that engage, excite and inspire. As a leading Canadian real estate investment advisor, we offer asset management, property management, development and specialized advisory services to pension funds and institutional clients. Our diverse portfolio includes residential, industrial, retail and office properties as well as an active pipeline of new development projects.